Dec 09, 2025

- Security is emerging as a decisive competitive factor across the Americas as ICAO standards tighten, CT screening and automated detection become mainstream, and cyber integrity gains equal importance to physical screening.

- The US is driving the pace with expanded CT adoption and a risk-based, multi-layered model, Canada is modernising steadily to align with US expectations, while Latin America shows strong potential but uneven capability, with major hubs investing and smaller airports constrained by legacy systems.

- The critical frontier is digital chain-of-custody: operators that integrate secure data flows with advanced screening will move freight faster and attract high-value e-commerce and pharma cargo, while those that lag risk congestion, compliance penalties, and loss of market share.

Airfreight has never been short on big themes—green fuels, automation, cross-border e-commerce—but as we look ahead to 2026, one issue is quietly creeping into the spotlight: security. Not so much the procedural kind, but a rapidly evolving mix of regulation, technology, and digital integrity that will define which airports and handlers gain a competitive edge across the Americas.

Globally, regulators are tightening standards, the Civil Aviation Organization (ICAO) guidance is getting sharper, and cyber threats are now treated with the same seriousness as physical screening. Yet the Americas tell a nuanced story — the US is accelerating fast, Canada is modernising deliberately, and Latin America sits at a crossroads between high-potential hubs and legacy bottlenecks.

A global shift, with Americas-specific stakes

Screening technologies are maturing quickly. CT scanners, multi-view X-ray, automated detection software, and stronger digital chain-of-custody rules are becoming the industry norm. ICAO’s security manual now emphasises integrated risk management, interoperability, and cyber-resilience.

But the Americas are entering this transition unevenly. The region’s biggest hubs are investing and upgrading, while risk-averse or airports with smaller budgets could get left behind.

The United States sets the pace

The US Transportation Security Administration (TSA) remains the heavyweight shaping security expectations across the hemisphere. TSA mandates that all cargo carried on passenger aircraft must be screened to passenger-equivalent standards, and its Certified Cargo Screening Program (CCSP) extends secure screening beyond the airport perimeter. (TSA)

“The way the Department of Homeland Security fashions the air cargo security process in the US is what they call a risk-based, multi-layered approach,” says Brandon Fried, executive director of the Airforwarders Association. “Now that we’re screening freight 100 percent, who cares who the shipper is? As long as we know what’s in that box, it’s not going to hurt anyone.”

What’s different heading into 2026 is how that screening will be enforced. TSA is pushing for wider adoption of CT scanners to improve 3D visibility and cut false alarms. However, US oversight bodies have noted that some early field tests lacked the necessary data, recommending stronger evaluation before nationwide deployment.

Layered on top is the cyber dimension. DHS has warned that cargo security now hinges on protecting the data flows that manage manifests and chain-of-custody. A physically screened pallet is meaningless if its digital trail is compromised.

For US cargo operators, and the Latin American and Canadian gateways that serve them, compliance is evolving from a baseline requirement to a competitive advantage.

Canada: a quiet moderniser

Canada is taking a more understated path. The Canadian Air Transport Security Authority (CATSA) has begun a national rollout of CT technology at major airports, signalling a major refresh of its screening infrastructure.

The direction is unmistakable: state-of-the-art machines, streamlined checkpoints, and enhanced digital integration. For cross-border cargo, especially automotive, aerospace, and perishables, alignment with US standards is key.

High Latin American upside

Latin America presents a highly diverse picture. Some of the Americas’ most dynamic export industries—flowers, perishables, pharmaceuticals, and nearshoring-driven manufacturing—depend on fast, secure airfreight. Yet security capabilities vary dramatically.

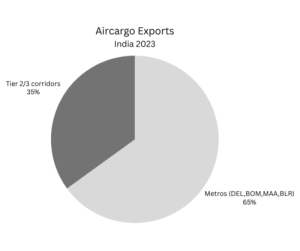

Major hubs such as Mexico City, Monterrey, São Paulo, Bogotá, and Santiago are investing in new screening equipment and digital upgrades. Nearshoring is pushing Mexico to scale up security capabilities for northbound e-commerce and electronics flows. Brazil’s pharma sector is exerting similar pressure.

But smaller airports often rely on older X-ray units and manual documentation. In many cases, the regulatory framework references ICAO Annex 17, but enforcement capacity varies widely.

As US and Canadian standards strengthen, Latin American airports that modernise will capture new opportunities, while those that lag may see reduced uplift from global partners.

A digital battleground

Across the Americas, the most important shift isn’t new machinery—it’s the move towards digital chain-of-custody. Airlines want complete visibility: who screened the cargo, when it was cleared, whether automated detection triggered a flag, and how that record flows through to ULDs and aircraft loading.

If even one link remains manual, the entire chain becomes vulnerable. The future therefore belongs to airports and handlers that can blend physical security with data integrity, resilient IT, secure manifests, tamper-proof tracking, and automation that reduces human error.

A competitive frontier

For the Americas, next year will be a turning point. Airports and handlers that invest will move freight faster, reduce false alarms, and strengthen relationships with e-commerce and pharma shippers.

Those that hesitate risk congestion, regulatory penalties, and erosion of their roles in hemispheric logistics.

Security is no longer a backstage conversation. In 2026, across the Americas, it will be centre-stage—a hallmark of who leads and who follows.

The post Security sets a competitive edge in the Americas appeared first on Air Cargo Week.

Go to Source

Author: Edward Hardy

Latest Posts