Jun 05, 2024

In 2023, air cargo volumes (chargeable weight) from China have increased by 5 percent compared to 2019. On the other hand, total outbound from China decreased 26 percent in 2023 compared to 2019. After a significant post-Covid surge of rates (USD per Kg) between 2019 and 2022, the rates for both outbound from and inbound to China are steadily decreasing. The inbound yield/rate for Year-to-Date Apr 2024 is almost reaching post-Covid levels.

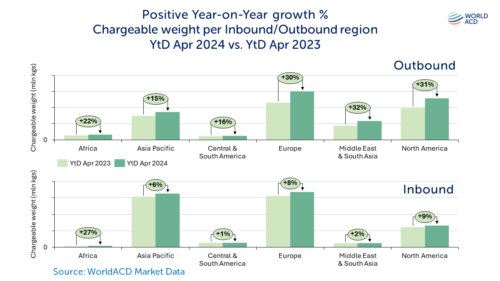

The development of air cargo between China and the rest of the world has been positive for all origin and destination regions. For example, outbound from China to Europe, Middle East & South Asia (MESA), and North America increased 30 percent, 32 percent, 31 percent in the first four months of 2024 (January to April) compared to the same period in 2023. Inbound air cargo from Europe, MESA, and North America increased 8 percent, 2 percent, and 9 percent.

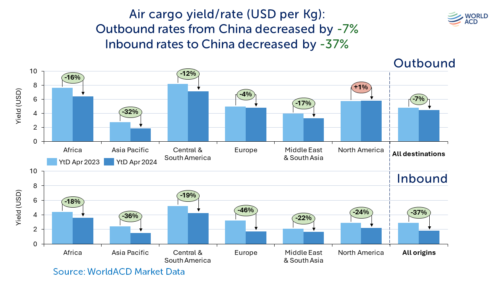

Yet another positive development for air cargo leaving from and arriving to China is related to the overall decrease in rates. For outbound shipments from China to the rest of the world, rates dropped 7 percent between January and April 2024 compared to the same period in 2023. Even more significant, rates dropped 37 percent for inbound shipments from the rest of the world to China. The only slight increase in rates in this specific period (Jan-Apr 2024 vs. 2023) occurred on air cargo shipped from China to North America.

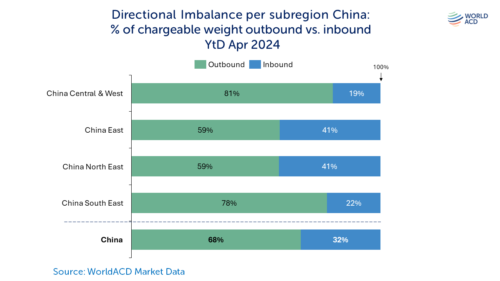

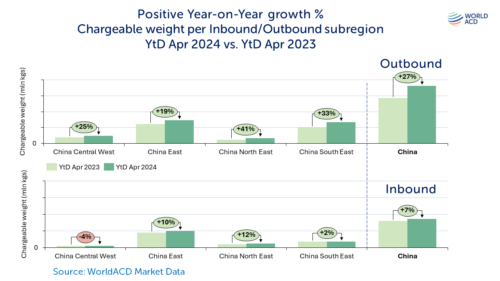

At WorldACD Market Data, China is divided into four different subregions to analyse and determine year-on-year growth of the air cargo business on a more detailed level. As it seems, the only subregion with decreased air cargo business in the first four months of 2024 compared to 2023 was inbound to China Central West. However, the inbound to China Central West accounted for less than ten percent of China’s total inbound (YtD Apr 2024).

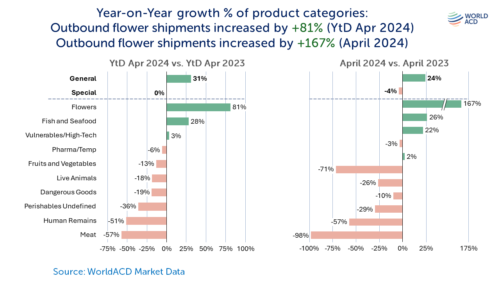

The Year-on-Year growth of air cargo between China and the rest of the world is a result of well-performing general cargo and only a few special product categories. Except for Flowers, Vulnerables/High-Tech, and Fish and Seafood, the outbound of special product categories in 2024 so far decreased by 6 percent (Pharma/Temp) up to 57 percent (Meat) compared to last year.

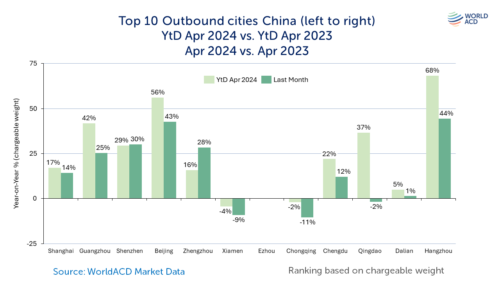

The majority of the top 10 air cargo cities in China continue to grow, resulting in positive double digits for 7 out of 10 cities ranked based on outbound chargeable weight. Guangzhou (ranked 2nd) and Beijing (ranked 4th) outbound volumes increased by 42 percent and 56 percent between January and April 2024 compared to the same period in 2023. Similarly, Chengdu (7th) and Hangzhou (10th) increased outbound air cargo by 22 percent and 68 percent.

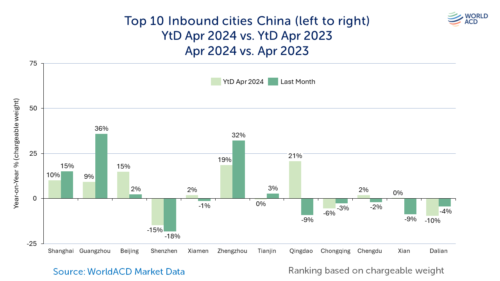

The inbound of air cargo to China’s top 10 inbound cities was somewhat less positive with decreased Year-on- Year growth in about half of these cities. Still, Shanghai, Guangzhou, and Beijing ranked 1st, 2nd, and 3rd , showed a positive Year-on-Year growth of at least 9 percent in the first four months of 2024 compared to 2023.

According to the most recent data of WorldACD Market Data, 68 percent of China’s air cargo business was accounted for by outbound shipments (Year-to-Date April 2024), due to a strong directional imbalance for all subregions in the country. In China’s Central & West subregion up to 81 percent of the total chargeable weight was flown out of the subregion from January to April 2024. In China East and North East roughly 41 percent was accounted for by inbound shipments, leaving over half of the total air cargo business in the subregion for outbound.

The post Inside China’s cargo market appeared first on Air Cargo Week.

Go to Source

Author: Edward Hardy