May 06, 2024

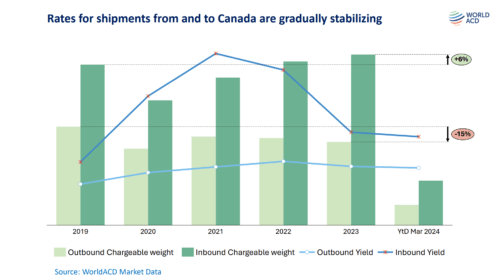

In the past few years, air cargo outbound and inbound from and to Canada has been relatively stable. Inbound volumes to Canada dropped -15% in between 2019 and 2023, whilst outbound volumes increased +6 percent in the same period. Yield rates (USD per kg) for inbound shipments to Canada surged between 2019 and 2021 (+170 percent) and have dropped to a rate of +40 percent in 2024 compared to 2019.

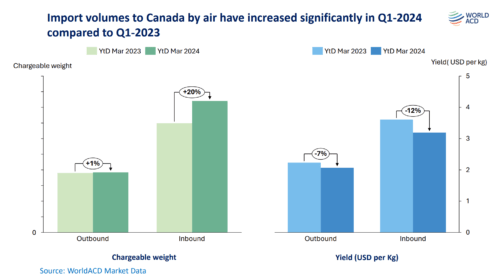

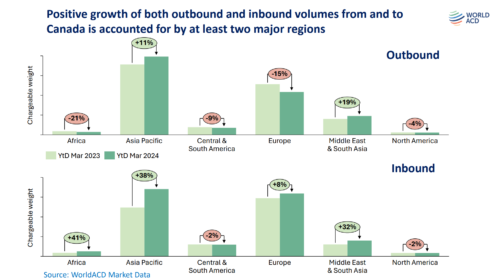

In Q1-2024 both outbound and inbound volumes from and to Canada increased compared to Q1-2023. The increase in inbound volumes is predominantly caused by three origin regions (see inbound figures below). Outbound volumes only increased for two out of six origin regions. Yield rates (USD per Kg) decreased for nearly all origin and destination regions except for shipments originating in the Middle East and South Asia and North America.

Both the Asia Pacific and Middle East & South Asia received +11 percent and +19 percent in terms of air cargo volumes from Canada in Q1-2024 compared to Q1-2023. In the first three months of 2024, Canada also handled +38 percent and +32 percent of air cargo shipments from the same regions Asia Pacific and Middle East and South Asia, as well as from Africa (+41 percent) compared to the first three months of 2023.

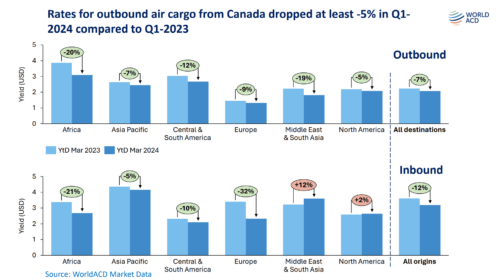

The development of yield rates (USD per kg) has shown a very positive trend at the beginning of 2024. Air cargo shipments from Canada to all destinations (regions) were priced at a rate between -5 percent and -20 percent lower in comparison to the beginning of 2023. Similarly, yield rates of shipments arriving in Canada were generally lower, apart from air cargo from the Middle East & South Asia and North America. For all origin regions, air cargo shipments were -12 percent in 2024.

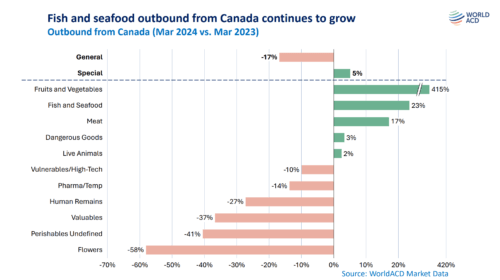

Approximately half of all outbound air cargo from Canada is labelled as a special product category. The majority of these special products are fish and seafood, vulnerable/high-tech, and Pharma/temp. However, whilst the fish and seafood product increased in March 2024 compared to March 2023 (+23 percent), both vulnerable/high-tech and pharma-temp volumes decreased in the same period, as well as air cargo volumes in the majority of special product categories.

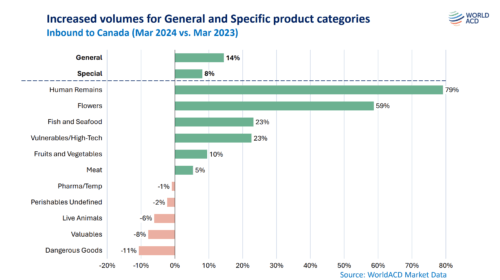

For air cargo shipments arriving to Canada, the majority of special products groups have increased in volume. Fish and seafood, which is predominantly exported has also been increasingly imported in Q1-2024 compared to Q1-2023. However, certain product categories were imported to Canada decreasingly, such as dangerous goods -11 percent, valuables -8 percent, and live animals -6 percent.

The post Canada’s airfreight landscape appeared first on Air Cargo Week.

Go to Source

Author: Edward Hardy

Latest Posts