Jan 19, 2026

- Global air cargo volumes jumped 26 percent in early January 2026 after the year-end slump, according to WorldACD.

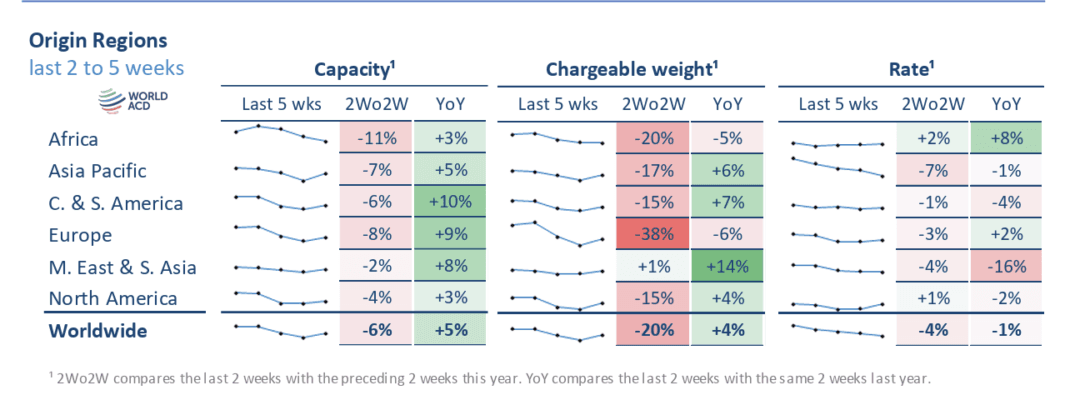

- The surge brings tonnage 5 percent above 2025 levels, led by strong growth from Asia Pacific, Middle East, and North America. Rates dipped slightly, while freighter capacity showed signs of recovery.

Global air cargo tonnages rebounded strongly in the first full week of 2026 in a manner similar to last year, but with chargeable weight around plus five percent above the equivalent levels a year ago, according to the latest weekly figures and analysis from WorldACD Market Data.

The charts in the pdf report contain our latest views on air cargo market developments.

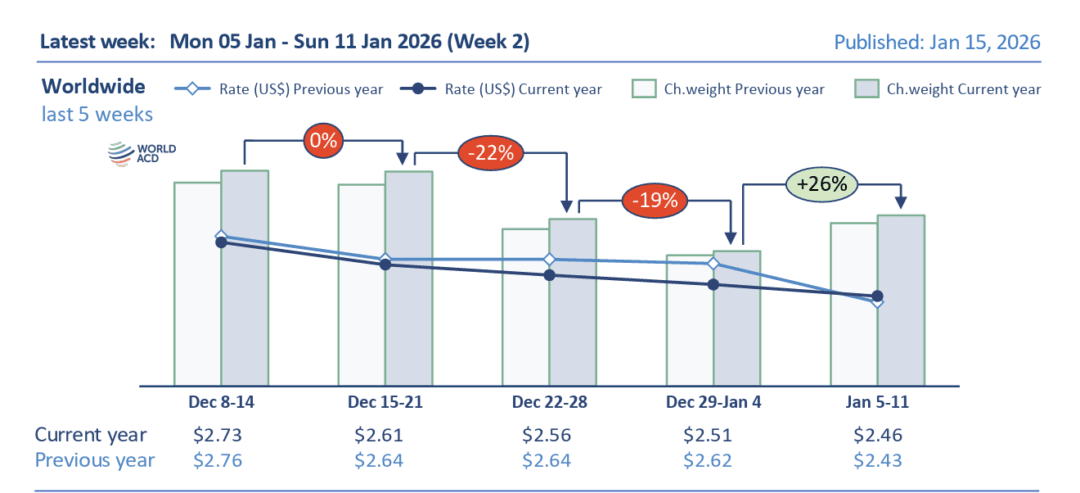

It covers each of the last five weeks up to Sunday January 11, 2026.

Preliminary figures for week two (5 to 11 January) point towards a resumption of some of the broad trends experienced in 2025, in which cargo tonnages rose by an average of plus four percent across the full year, with rates averaging slightly below their level the previous year. It’s worth noting, however, that 2025 began relatively slowly, with year-on-year growth averaging plus two percent last January and February, and therefore early signs of year-on-year growth in 2026 should be seen in that context.

Week-on-week rebound

Worldwide air cargo tonnages in week two recorded a plus twenty-six percent week-on-week rebound, following consecutive steep weekly drops of minus twenty-two percent and minus nineteen percent at the end of last year, leaving worldwide tonnages still minus twenty percent below their mid-December levels, based on the more than 500,000 weekly transactions covered by WorldACD’s data. The strong rebound in week two can be seen across all origin regions except for Africa.

Capacity partially returned after freighter services were cut back sharply at the end of last year from their peak levels in the final quarter, as is normal for the season. Freighter capacity regained more than plus fifteen percent in week two, week-on-week, although overall air cargo capacity remains around minus seven percent down compared with mid-December.

Average worldwide rates slipped downwards by a further minus two percent, week-on-week, to US$2.46 per kilo. That’s around minus ten percent below their average level in mid-December, but it’s slightly above (plus one percent) the $2.43 full-market average rate this time last year.

Year-on-year tonnage growth continues

The year-on-year worldwide tonnage growth of plus five percent in week two was led, in percentage terms, by increases in traffic from Middle East & South Asia (MESA, plus sixteen percent), Asia Pacific (plus eight percent), and North America (plus seven percent) origins, although in absolute terms the biggest factor was a further year-on-year increase in cargo from Asia Pacific origins. That plus eight percent year-on-year growth in cargo from Asia Pacific origins was in line with the average year-on-year increase in traffic from Asia Pacific origins of plus eight percent for the full year in 2025.

Examining individual major markets from Asia Pacific also reveals a continuation of some of last year’s patterns, with tonnages in week two from Asia Pacific to the US up by plus ten percent, year-on-year, mainly driven by strong traffic growth from Southeast Asia origins, while chargeable weight from China and Hong Kong to the US was flat, year-on-year.

Meanwhile, from Asia Pacific origins to Europe, tonnages in week two were up plus fifteen percent, year-on-year, mainly driven by growth from China, Hong Kong, Taiwan and Thailand. But that very high year-on-year growth rate partly reflects a slow start last year in volumes from Asia Pacific to Europe: volumes from China and Hong Kong to Europe last January were up by a relatively modest plus three percent, but tonnages from Southeast Asia to Europe were down minus seventeen percent, year-on-year, resulting in a slight decrease in overall Asia Pacific to Europe volumes in the first few weeks of 2025.

Dynamic MESA market

Total tonnages from MESA origins last year were roughly the same as in 2024, taken as a whole, although MESA origin markets saw significant year-on-year growth in the final two months of 2025, of plus thirteen percent and plus eleven percent, respectively, in November and December. The plus sixteen percent year-on-year growth from MESA origins in week two is, therefore, broadly consistent with those patterns, boosted by a particularly strong year-on-year rise from Dubai. MESA to US tonnages were up plus ten percent, driven by traffic growth from Dubai, India and Bangladesh, and MESA to Europe volumes were up by plus sixteen percent, also driven by traffic growth from Dubai, India and Bangladesh.

Some container shipping services have been returning in recent weeks to the Red Sea route via the Suez Canal, with Maersk this week the latest to announce a limited resumption of services, although volumes remain less than half their level prior to the onset of attacks by Houthis on shipping more than two years ago. Returning capacity to that market is likely to be a factor for air cargo, which has seen higher volumes from that region in the last two years, although the latest tensions between the US and Iran highlight continuing instability in that region that is likely to limit or slow down a full return to pre-2023 supply chain patterns.

Spot rate declines

Average global spot rates in week two slipped slightly further downwards (minus one percent, week-on-week), to US$2.62 per kilo, despite plus six percent week-on-week rises from North America and Africa origins, with spot rates ex-Asia Pacific losing minus five percent, week-on-week. Compared with this time last year, global spot rates in week two were down minus four percent, year-on-year, largely due to declines from MESA (minus twenty-one percent), Asia Pacific (minus six percent) and Europe (minus four percent) origins, partially offset by a plus twelve percent rise from Africa origins.

The post Global air cargo rebounds 26 percent in first full week of 2026 appeared first on Air Cargo Week.

Go to Source

Author: Anastasiya Simsek