Dec 02, 2025

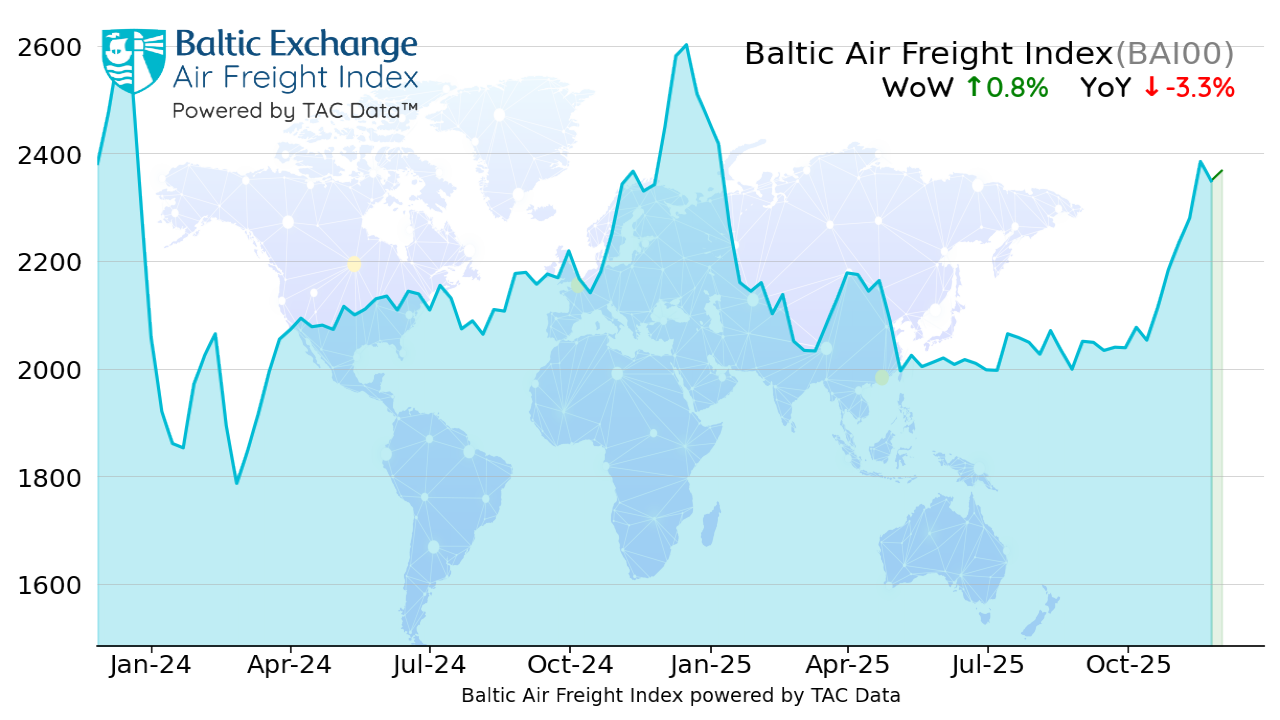

- Global air cargo rates edged up 0.8% last week, according to TAC Index, as the market moved through the first phase of its typical peak season around Thanksgiving and Black Friday.

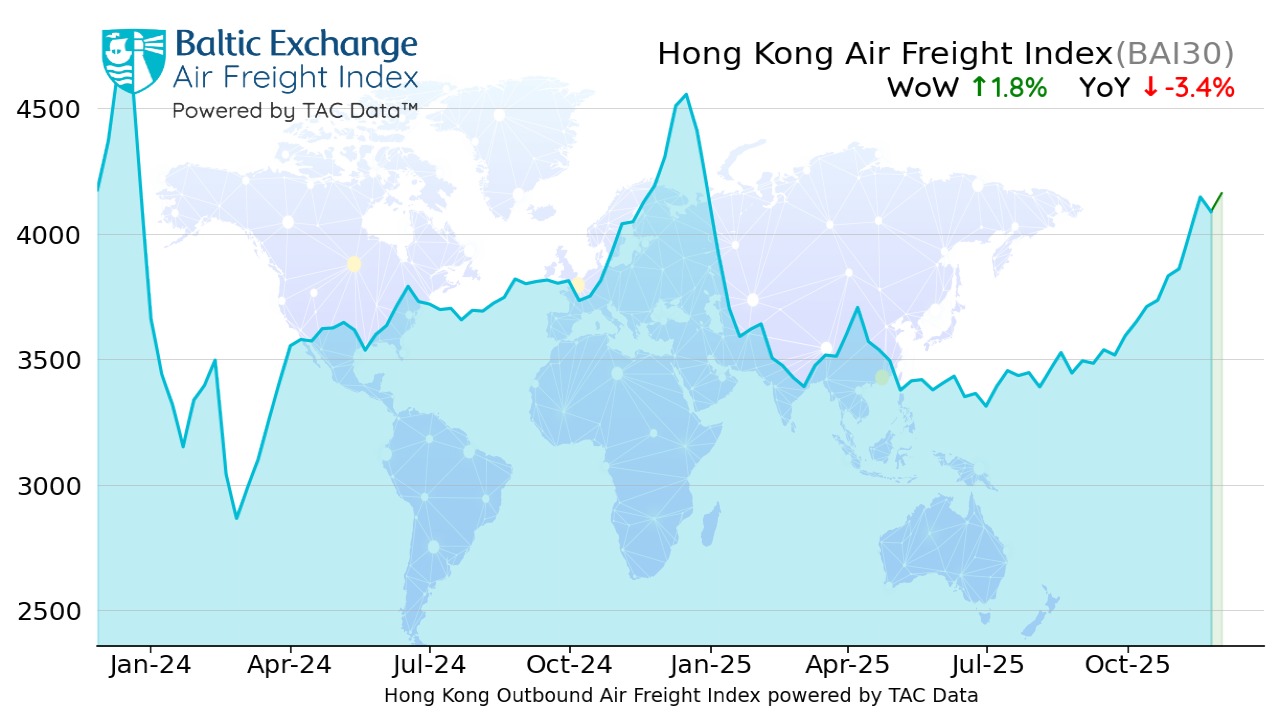

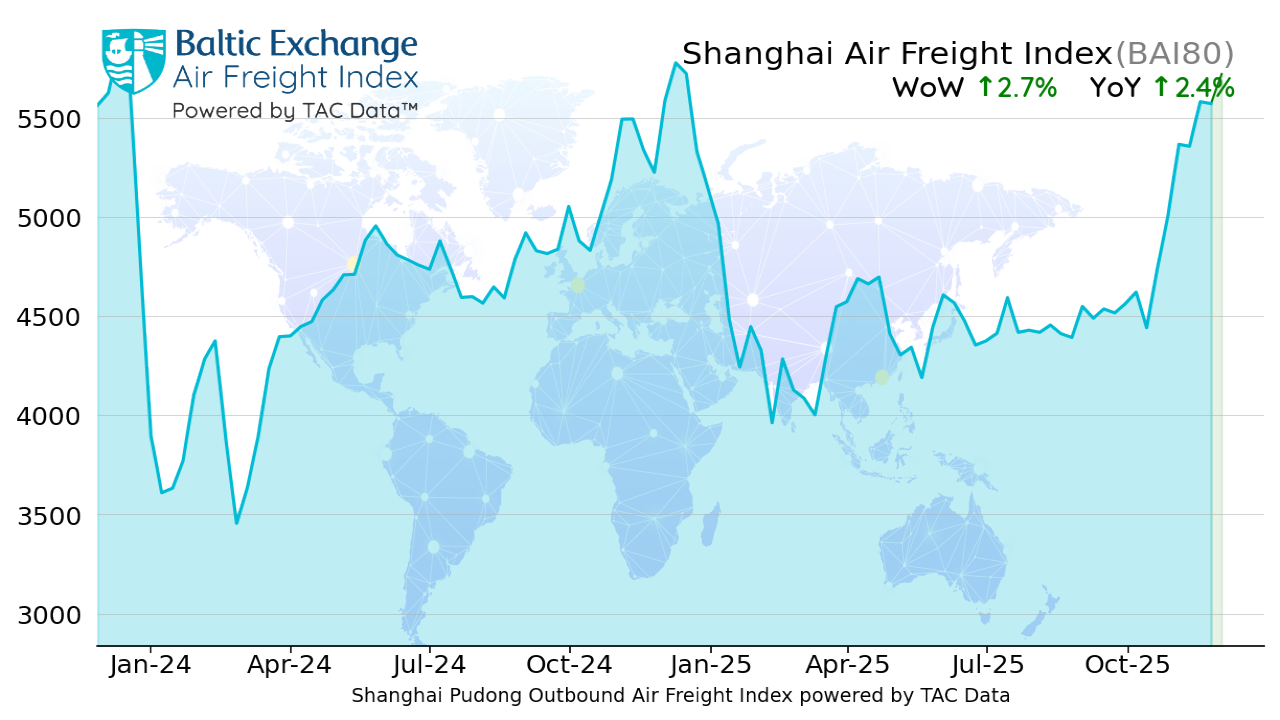

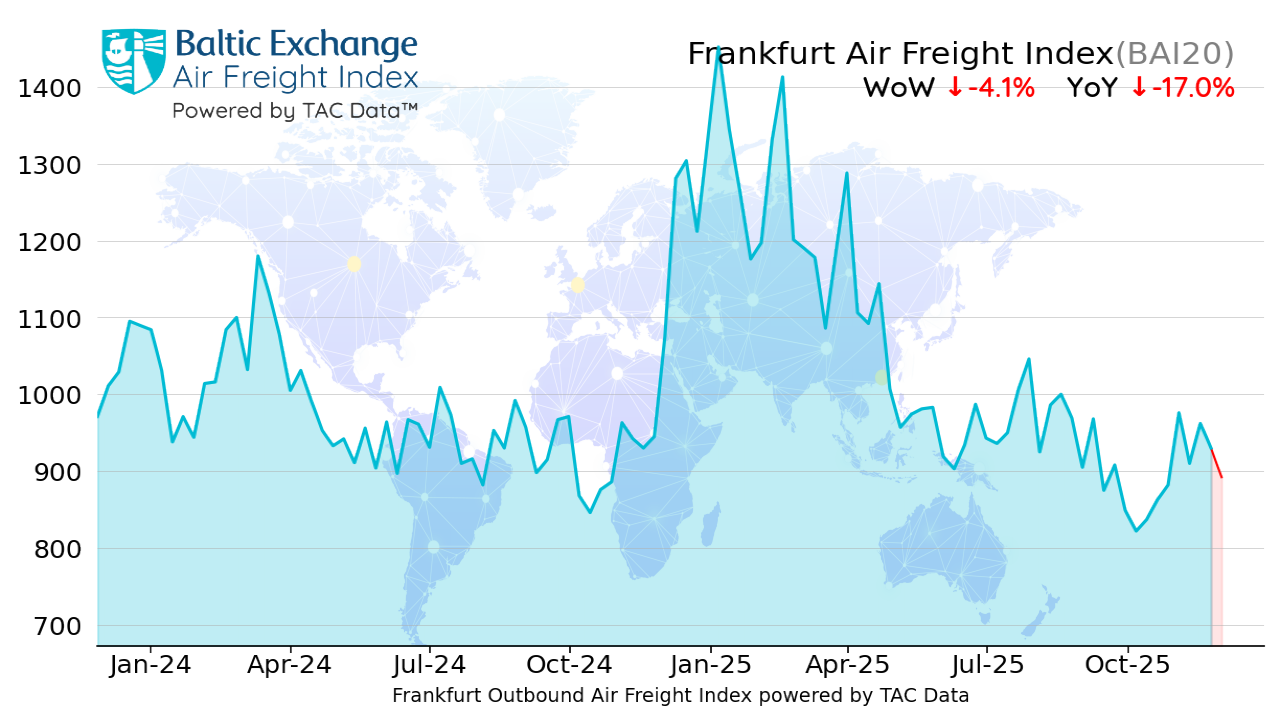

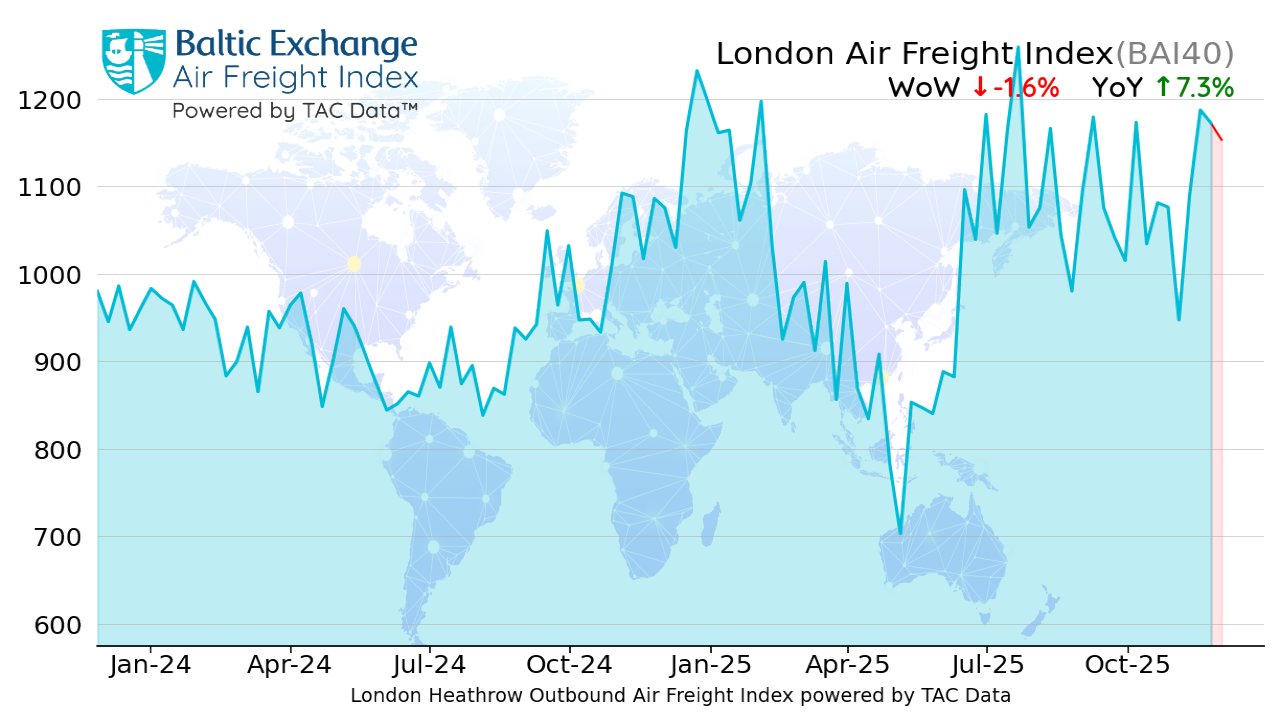

- Gains were driven by strong rate increases from China to both Europe and the US, particularly out of Shanghai (+2.7% WoW) and Hong Kong (+1.8% WoW). Meanwhile, rates from India dropped in both directions, and European outbound rates showed mixed results — with Frankfurt down -4.1% WoW and London Heathrow slightly lower at -1.6% WoW.

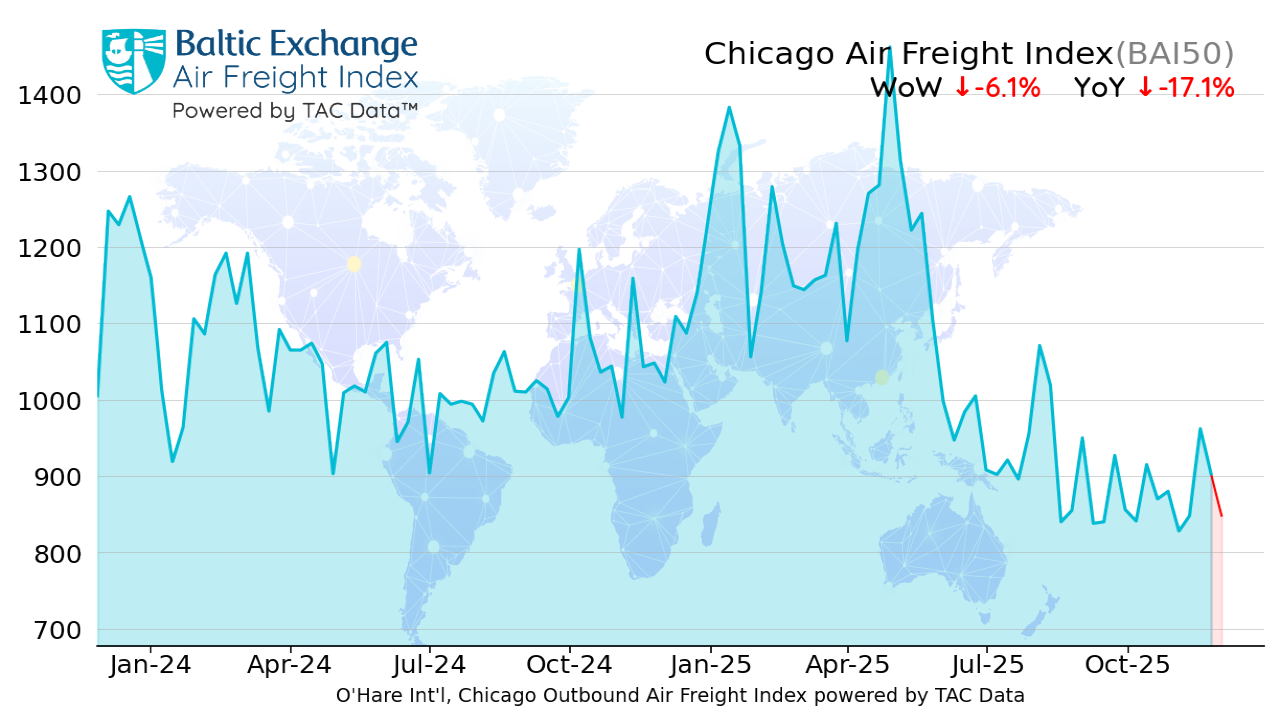

- US outbound rates continued to decline, notably from Chicago (-6.1% WoW). Despite current gains, the overall global Baltic Air Freight Index remains down 3.3% compared to the same period last year.

Global airfreight rates edged up again last week as the market completed the first phase of its usual peak season rise into Thanksgiving and Black Friday, according to the latest data from TAC Index, the leading price reporting agency for air freight markets. The global Baltic Air Freight Index (BAI00) calculated by TAC gained +0.8% in the week to December 1, leaving it lower but by only -3.3% from 12 months earlier when there had been a significant peak season surge.

The market was led higher again by further gains on the biggest lanes out of China both to Europe and the US. Notwithstanding a brief pause over Thanksgiving, BAI Spot rates from Hong Kong to the US and Europe continued to rise sharply over the week. The full index of outbound routes from Hong Kong (BAI30) – reflecting the full spectrum of spot and forward rates being paid – gained a more modest +1.8% WoW to leave it lower at -3.4% YoY. Outbound Shanghai (BAI80) was also up +2.7% WoW to leave it ahead at +2.4% YoY. From Vietnam rates were little changed, while both from Bangkok and from Seoul rates were up to the US but down to Europe. From Taiwan, rates were up to Europe but down to the US. From India, rates were lower in both directions.

From Europe rate patterns were also mixed, with further gains on Transatlantic lanes to the US as well as to China, Japan and Mexico – but falls on lanes to Australia, Brazil, India, South Africa and the UAE. The index of outbound routes from Frankfurt (BAI20) tumbled -4.1% WoW to leave it languishing at -17.0% YoY from where it was a year earlier – when it was entering a pronounced peak season spike. Outbound London Heathrow (BAI40) was also lower though by only -1.6% WoW – leaving it still comfortably ahead at +7.3% YoY.

Rates from the US continued to languish – with falls again WoW on routes to Europe, China and South America, despite a renewed rise on the busiest lanes southbound from Miami. The index of outbound routes from Chicago (BAI50) dropped -6.1% WoW to leave it lower at -17.1% YoY. Rates from Mexico to Europe – one of more than 20 lanes added to the data set since last July – also fell back sharply WoW after recent gains, pushing them back into negative territory YoY.

Global airfreight rates edged up again last week as the market completed the first phase of its usual peak season rise into Thanksgiving and Black Friday, according to the latest data from TAC Index, the leading price reporting agency for air freight markets. The global Baltic Air Freight Index (BAI00) calculated by TAC gained +0.8% in the week to December 1, leaving it lower but by only -3.3% from 12 months earlier when there had been a significant peak season surge.

The market was led higher again by further gains on the biggest lanes out of China both to Europe and the US. Notwithstanding a brief pause over Thanksgiving, BAI Spot rates from Hong Kong to the US and Europe continued to rise sharply over the week. The full index of outbound routes from Hong Kong (BAI30) – reflecting the full spectrum of spot and forward rates being paid – gained a more modest +1.8% WoW to leave it lower at -3.4% YoY. Outbound Shanghai (BAI80) was also up +2.7% WoW to leave it ahead at +2.4% YoY. From Vietnam rates were little changed, while both from Bangkok and from Seoul rates were up to the US but down to Europe. From Taiwan, rates were up to Europe but down to the US. From India, rates were lower in both directions.

From Europe rate patterns were also mixed, with further gains on Transatlantic lanes to the US as well as to China, Japan and Mexico – but falls on lanes to Australia, Brazil, India, South Africa and the UAE. The index of outbound routes from Frankfurt (BAI20) tumbled -4.1% WoW to leave it languishing at -17.0% YoY from where it was a year earlier – when it was entering a pronounced peak season spike. Outbound London Heathrow (BAI40) was also lower though by only -1.6% WoW – leaving it still comfortably ahead at +7.3% YoY.

Rates from the US continued to languish – with falls again WoW on routes to Europe, China and South America, despite a renewed rise on the busiest lanes southbound from Miami. The index of outbound routes from Chicago (BAI50) dropped -6.1% WoW to leave it lower at -17.1% YoY. Rates from Mexico to Europe – one of more than 20 lanes added to the data set since last July – also fell back sharply WoW after recent gains, pushing them back into negative territory YoY.

The post TAC Index: Airfreight rates inch up post-Thanksgiving amid mixed global trends appeared first on Air Cargo Week.

Go to Source

Author: Anastasiya Simsek